Disclaimer: I am not a financial advisor, and nothing in this article is financial advise. Investing in cryptocurrencies and derivatives is risky and can lead to total loss of principal. This article is for informational purposes only and does not constitute an endorsement of any specific asset or investment strategy. I have long positions in ETFs IBIT and SSK

When Bitcoin was introduced, it was revolutionary. The idea of peer-to-peer cash (a use case that didn’t even win out in the long run FWIW) was novel in 2008, but the reality is that Bitcoin is a much different asset in 2025. It is commonly seen as a store of value and an idiosyncratic hedge against monetary debasement or other serious errors in monetary or fiscal policy. This is aided by its relatively conservative technical culture. Bitcoin investors and miners can be relatively confident that the rules of the Bitcoin game will not be changed on them arbitrarily and harmfully because it is intentionally hard to change the protocol in that way. Even though Bitcoin often still trades correlated with public equities and is usually seen as a risk-on asset, it actually may be a defensive pick within the cryptocurrency sector at this point.

For investors that actually want to try be closer to the cutting edge of the idea of programmable money at the L1 level (while still investing in assets that have actual ETFs for them instead of pure speculative junk), Ethereum (native token ETH) and Solana (native token SOL) are the two most popular options. While they have different individual strengths and weaknesses, the general idea is that if you are at all bullish on the idea of programmable, composable finance or decentralized apps (DApps), then these assets that may have the potential to outperform Bitcoin. With its low gas fees and quick settlement, Solana has found favor with retail users, while Ethereum is more of an institutional infrastructure play at this point.

Whether you are bullish on crypto or bearish/disdainful of it, I argue that Donald Trump is making it a part of the political economy that we can’t ignore. Trump’s media company is currently seeking to launch multiple ETFs for large-cap cryptocurrencies. Additionally, the Solana blockchain was used to launch the Trump memecoin. Assuming Trump’s ETFs are eventually approved, we will be in an unprecedented position. Not only are the president’s assets not in a blind trust, but he is also going to have ownership interest in the management of crypto investment funds. It’s in his interest to pump his AUM, no? And even if we assume moral purity (lol), the incentives and proximity must cause at least some unconscious bias in his decision-making, right?

Additionally, crypto is inherently a hyper-political asset class because it has striven to provide financial products and services that are outside the regulatory and mental frameworks of traditional finance. Realization of the maximalist, bull case for crypto was always going to depend on a clash with regulators. Additionally, crypto’s relatively small market cap (compared to gold, equity indices, etc.) makes it ripe for manipulation, and a “Bitcoin National Reserve” is more political palatable than just handing government cash to shareholders of Trump companies.

Bitcoin’s strength this year has been aided by institutional/whale demand for hedges against chaos that Trump himself has causing, creating weird feedback loops and incentives.

Both in practice and in theory, crypto is useful for rent-seeking and market manipulation by Trump and allies, and investors might want to profit from this by trying to frontrun further crypto inflows. But you probably wonder, “if Trump is manipulating crypto, how are you confident you aren’t one of the suckers getting rekt?”

Regard the above, I absolutely am not confident (no investor ever should be), and that’s why I think there’s a need for a metrics-based perspective. A lot of crypto investors and traders focus on emotional stuff such as their personal reaction to regulatory news, their ideologies about decentralized tech, and highly subjective forms of TA (what I would call “chart astrology”).

Therefore, I argue that the price trends in the SOL-BTC and ETH-BTC pairs are informative not just narrowly to cryptocurrency (ETF) investors, but also to anyone trying to get a deeper understanding of the political economy of the 2nd Trump administration. Since there are multiple different forces and types of investors driving prices in crypto, I think the trend of SOL vs. BTC can help us distinguish what is the driving force in the crypto market at the moment, mememetic liquitity or institutional interests. Additionally price momentum in SOL almost by definition indicates an “Altcoin Season.”

With 62% of surveyed millennial ETF investors planning to allocate into crypto ETFs (even more than stocks!) this is potentially a big lever with which Trump and Republicans can influence generational political attitudes and wealth redistribution.

In this article, I will analyze the price trends of Solana (SOL) and Ethereum (ETH) against Bitcoin (BTC) to determine whether they are growth assets relative to BTC. I will also look at the current trends in these assets to see if they are currently trending up or down. Lastly, I will show some risk estimates to estimate how much “Bitcoin” we might lose in one day in a worst case scenario invested in ETH or SOL.

With both Solana and Ethereum having staking-enabled ETFs currently or on the horizon, I think this analysis could inform or inspire various strategies for staking and trading these assets on the public markets. Also, institutional access to and interest in staking could drive further price appreciation (both in BTC and USD terms).

The Bull Case for ETH and SOL

There are many reasons why an investor might believe that ETH or SOL are growth assets within the crypto sector. I’m not trying to formalize an investment thesis here, but it’s always good to lay the groundwork for that eventual investment thesis that may have quantitative, political economy, or technological aspects. Here are some arguments that I think are worth considering:

- Proof of Stake (PoS) is more environmentally friendly than Proof of Work (PoW).

- Inherent utility of native token: Both ETH and SOL can be staked to earn rewards (basically a form of interest) for lending your assets to help secure the network.

- Growth from Programmability/Defi: Both of these chains are focused on their developer experience and communities, so there is potential for exponential growth in usage in both chains as killer use cases are invented and exploited with apps and protocols. Also, there is a lot of potential for composability within and between the ecosystems.

- Legislative tailwinds: With legislation like the GENIUS Act and other bills, both chains could see more usage for stablecoin “payments” (which misses the point IMO, but we have to figure that the GENIUS Act was written by bank lobbyists), tokenized stock trading, and more.

- Exposure to growth in institutional interest in staking: with staking-enabled ETFs just now becoming a thing in the US, we could potentially see a lot of growth in the amount of institutional capital seeking yield on these blockchains

- Memetic activity: Exposure to price action from popularity of memecoins, NFTs, and other memetic, speculative assets on-chain (especially SOL)

The point of this section is not to convince you that Solana or Ethereum are great, but my position is that technologies with these qualities (even if speculative) are worth evaluating further to determine if they are actually growth assets (relative to BTC) or not using quantitative methods. There’s at least a theoretical foundation for why they could be. And if I don’t do that analysis, I may as well sit on Reddit and make some ideological post about blockchain decentralization or whatever. Real investors need data to back up the narrative.

Bear Case on ETH and SOL

For the sake of genuine balance and fairness, here are some of the common bearish arguments against ETH and SOL:

- Less decentralization than Bitcoin: Ethereum is more decentralized than Solana, but Solana is less decentralized than ETH L2s like Optimism and Arbitrum. Pick your loser here (there are genuine tradeoffs, but a lot of crypto people are deeply attached to a specific notion of decentralization)

- Regulatory risk: Kind of obvious

- Gaming usecase is not the future: I don’t want to play a game where I have to pay like $100 in crypto to buy a spaceship and then the in-game currency is a volatility token in the real-world Solana Defi ecosystem. Nobody does, really. Gaming is a hobby and escape. That’s a miserable job.

- Inflationary on-chain economy: SOL and ETH don’t have the same “hard money” appeal as BTC

Regression Modeling: Are SOL and ETH Growth Assets (historically)?

Although it’s sensitive to the starting date, one way to analyze SOL and ETH is by fitting and comparing linear regression models on their price against BTC. The goal is to establish whether we should consider them growth assets relative to Bitcoin.

Both models use data starting on September 1, 2020, which is an arbitrary date that is after the 2020 DeFi summer. The models will be fitted to the daily closing prices of each asset, and we will compare the slopes of the two models to see if one is a better growth asset than the other.

I think this test also helps contextualize staking yield, which is theoretically one of the draws of investing in a proof-of-stake blockchain. If the asset is bleeding value to BTC in the long run, then BTC-denominated investing minds are likely to view staking yield as not being “real return” because the BTC-denominated wealth would be declining while holding the staked assets instead of Bitcoin. If an asset is growing against BTC in the long run, then staking yield could be a powerful compounding boost.

First, the summary of the model for Solana’s SOL:

Call:

lm(formula = value ~ time, data = .)

Residuals:

Min 1Q Median 3Q Max

-0.0011275 -0.0007787 -0.0001457 0.0004724 0.0028966

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -9.645e-03 7.874e-04 -12.25 <2e-16 ***

time 5.786e-07 4.057e-08 14.26 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.0008895 on 1791 degrees of freedom

Multiple R-squared: 0.102, Adjusted R-squared: 0.1015

F-statistic: 203.4 on 1 and 1791 DF, p-value: < 2.2e-16

The positive slope for time and its statistically significant p-value suggest that SOL has been a growth asset against BTC in the timeframe I tested. R-squared is low, but that’s to be expected. “Solana go up vs. BTC over time” was always going to be an overly simplistic model that doesn’t explain all the variance in the data (which is quite noisy with crypto markets).

Crucially the confidence interval for the slope does not include zero. This means that we can be reasonably confident that SOL has been a growth asset against BTC in the time frame I tested.

2.5 % 97.5 %

time 4.990211e-07 6.581532e-07

Now, let’s look at the model summary for Ethereum’s ETH:

Call:

lm(formula = value ~ time, data = .)

Residuals:

Min 1Q Median 3Q Max

-0.038525 -0.011584 0.004485 0.012679 0.029222

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 2.718e-01 1.461e-02 18.60 <2e-16 ***

time -1.123e-05 7.527e-07 -14.93 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.01652 on 1792 degrees of freedom

Multiple R-squared: 0.1106, Adjusted R-squared: 0.1101

F-statistic: 222.8 on 1 and 1792 DF, p-value: < 2.2e-16

The model for ETH has a negative slope for time as well as a significant p-value. This suggests that ETH is unproven as a growth asset against BTC in the time frame I tested.

Sure, I could choose to change the start date to the bottom of the last bear market to try gettting a significant p-value for ETH. The point is to test for long-run growth between crypto market cycles. While ETH occasionally has periods where it outperforms BTC, I don’t see evidence that grows vs. BTC in the long run.

Finally, let’s look at the 95% confidence interval for the slope of the ETH model:

2.5 % 97.5 %

time -1.270982e-05 -9.75748e-06

Given that our 95% confidence interval for the slope of the ETH model includes zero, we cannot conclude that ETH has been a growth asset against BTC in the time frame I tested.

Technical Analysis: What is the Current Trend?

In trend following strategies, traders attempt to buy assets when the price is trending up and sell when the price is trending down. While testing any specific trend-following strategy is beyond the scope of this article (and would almost certainly be misleading to show due to its sensitivity to various starting parameters), I still think looking at moving average crossovers (like 50 and 200 day) can be useful in visualizing the current trends of SOL and ETH.

Note that neither trend-following traders nor my analysis here attempt to predict the future. We are just trying to respond to whether the asset price is going up or down.

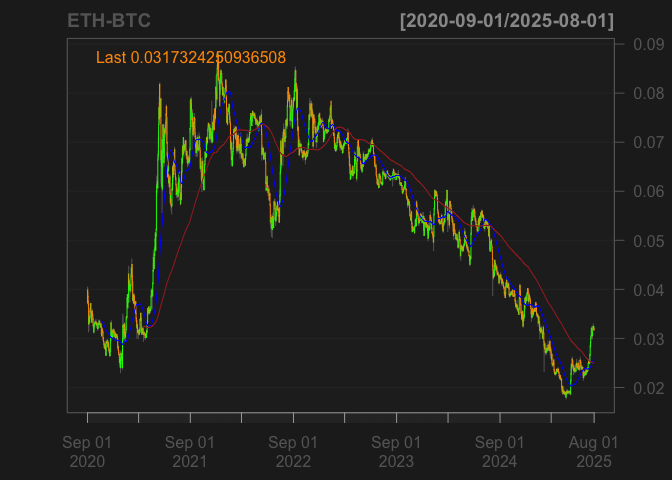

While I think the SOL-BTC chart is more interesting and informative, I will start with the ETH-BTC chart since I am sure many of you are dying for a visual of the slope I estimated in the previous section. (50 day moving average in blue, 200 day in red)

I think this chart reinforces the lackluster growth story for ETH against BTC in the long run. However, the 50-day moving average recently crossed above the 200-day moving average, indicating the start of a potential uptrend. From the perspective of a trend-following trader trying to maximize BTC-denominated wealth, this might be a good time to shift exposure from BTC to ETH (including using their ETFs if that’s how you prefer).

Even though I have expressed skepticism about holding ETH long-term based on the analysis so far, there’s still value in something that can outperform BTC in runs that can be captured by trading, given Bitcoin’s scarcity.

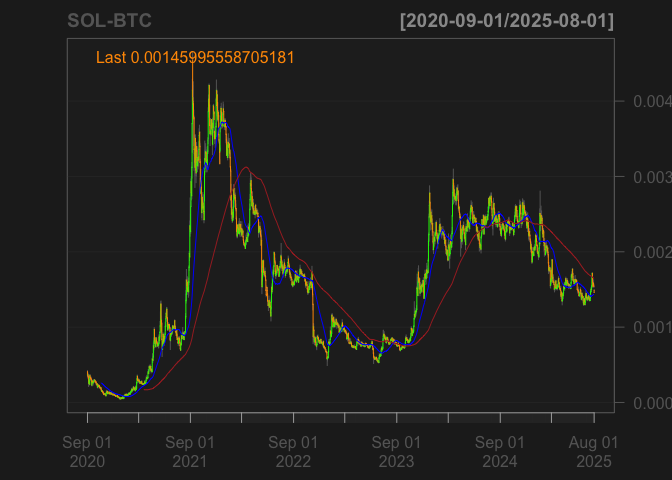

I think the SOL-BTC chart makes the uptrend from the previous section obvious, along with the sensitivity of the slope to the starting date. However, it does appear more bullish than ETH-BTC over the long run.

Right now, with the 50-day moving average below the 200-day moving average, SOL-BTC is in a downtrend. This might inform an investor to hold off on buying/staking more SOL until an uptrend resumes. If there is a remaining stake in SOL, staking rewards could be sold for BTC (or equities) until we see SOL trending upwards again.

With ETH in the beginning of an uptrend against BTC and SOL in a downtrend, it seems to me that institutional strength and demand is driving crypto rather than retail euphoria.

I think both charts also show that there was downside avoided by selling at the “death cross” (50-day below 200-day) in the past, even though it is a lagging indicator.

How Much BTC can We Lose (or Earn) in a Day?

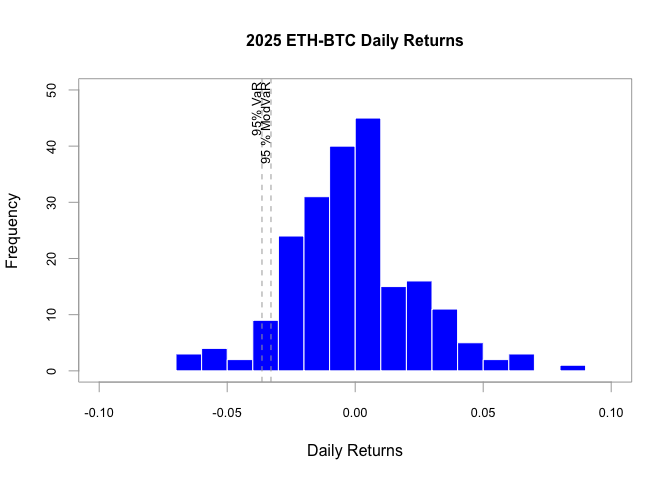

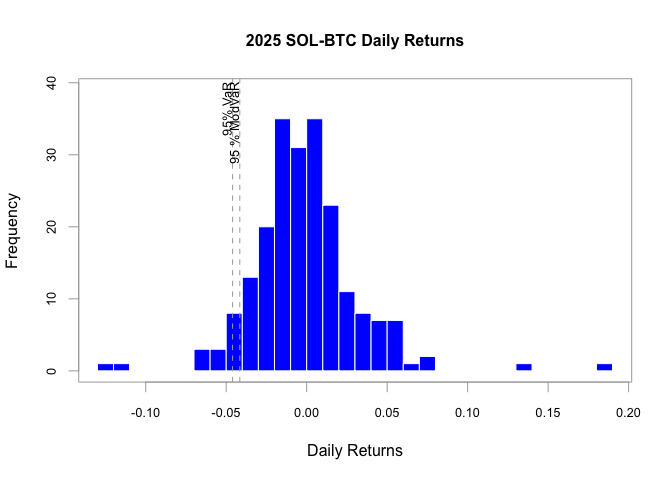

Finally, with respect to both staking and trading, we should have some estimate of how much BTC value our SOL or ETH position could lose in one day. Let’s look at histograms of daily returns for both, including estimates of Value at Risk.

I’m going to focus on 2025 here since using a longer time frame might skew the results with data that isn’t representative of the current risk/economic regime.

With both SOL and ETH this year, I estimate that 95% of days, you will lose less than 4-5% of your assets’ BTC value. It appears SOL’s distribution might have a fatter tail than ETH’s.

Stakers might be interested in estimating the VaR over longer time periods (weekly or monthly) too.

Unfortunately for those of us that trade ETH and SOL via ETFs and CME futures, we generally can’t set stop loss orders in terms of BTC price levels.

Conclusions

My analysis shows evidence that SOL has been a growth asset against BTC since September 2020, while ETH has not. This makes Solana a more attractive option to me for long-term staking. Although it’s unproven in terms of tracking the SOL price accurately, the SSK ETF seems attractive for Solana investors that want to stake but receive dividends as cash in their brokerage account.

If you are a Bitcoin bull or even maximalist, I don’t think you can ignore Solana’s track record of appreciating against Bitcoin. The whole argument for Bitcoin is that you can’t create more of it out of thin air.

I am not writing off ETH, but I am viewing it more as a tactical trading asset rather than something inherently worth holding long-term. But things change quickly, and the current trend appears bullish for ETH…

With the advent of staking in ETFs, it gives investors interesting optionality to try and seek yield or trade out of the position on the public markets any time they’re open. With pure, native, on-chain staking, you are locked into the position for a period of time.

Unless trading/staking in a tax-advantaged account, any sort of position adjustment could have tax implications, and this can affect what’s “optimal” in ways that I haven’t discussed in this article (and wouldn’t because I’m not a tax attorney!)

Navigating the cyclical behavior of cryptocurrency (relative to USD) is tricky, even after you’ve experienced real upside. But focusing on what’s appreciating relative to Bitcoin can help cut through some of the noise, in my opinion. Large USD-denominated drawdowns should still be expected though!

It will be interesting to see how actions of Trump and Congress affect crypto further. If investors have rules-based ways of trading, accumulating, and rebalancing positions, it can reduce the risk of making emotional decisions in response to market volatility (which is likely to be manipulated).

Once again, I am not a financial advisor, and I am posting this article for informational purposes only. I am not endorsing any specific asset or investment strategy. Always do your own research.

If you find this article a little bit too degenerate for your tastes, I also have some ETF research on boring old dividend growth funds that I plan to publish as my next article in this series.